How Does The Currency Strength Meter Work?

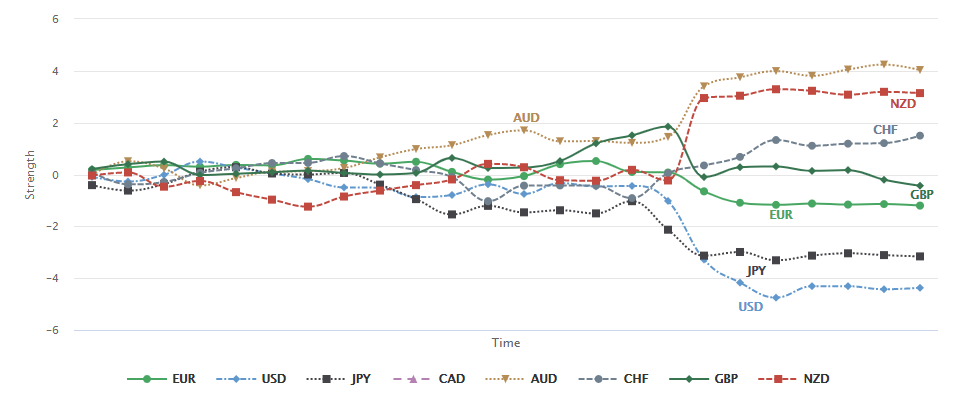

The Currency Strength Meter is a visual guide to Forex strength. It tracks the strength of all currency pairs and calculates the relative strength for each currency. The Currency Strength Meter helps Forex traders know if their positions are being affected positively or negatively by current market conditions. The meter is available in all time frames and can be used for various purposes. For example, EUR might be strong for today's time frame but weak for monthly time frames. It is best to use the gage as an additional confirmation for your decision - the Forex strength meter will help you make good trading decisions.

The relative strength of a currency is an important indicator for traders. The stronger a currency is, the more valuable it is. To be successful as a trader, it is important to understand the intricacies of each currency. One popular method is to compare the recent percentage change of one currency to another.

The world is facing many economic difficulties. The top ten strongest currencies for 2021 are listed below. This list also includes the weakest currencies that just missed this list but could be strong in the near future. Currency strength is determined by the relative purchasing power of a national currency when it is traded for products or against other currencies. The strength of a currency is determined by a variety of factors such as demand and supply in the foreign exchange markets.

Top ten currencies

- US Dollar

- Euro

- Japanese Yen

- Chinese Yuan

- Swiss Franc

- British Pound

- Brazilian Real

- Australian Dollar

- Canadian Dollar

- Mexican Peso

How strong is the dollar?

In this world where everyone is looking for protection, the US dollar is considered the strongest currency. The strength of the US dollar can affect the domestic economy and international trade in various ways. In some countries, many businesses have to borrow in USD and earn revenue in their domestic currency. An example of this is developing countries with unstable currencies or currencies with high volatility. The Swiss franc is the weakest currency as it is only 3.7% of the Dixie and has 57% weight. The US Dollar Index (Dixie) is based on the Euro/USD currency pair and the Euro-Dollar. Its popularity shows the preference for the home country economy as a reserve currency and people's confidence. The index tracks a weighted average of the US dollar against the major trading partners of five economic powers, four of which have their own currencies in the mix.

During this time, popular emerging market currencies are measured against the euro or dollar. For example, if the Chinese Yuan in the USD/CNY currency pair is gaining against the U.S. dollar, it means China's economy is gaining strength. There are also indicators that tell you how strong an economy is.

The USD is the most popular currency in the world. It is part of a group called the major currencies. One of the many uses of the USD is for trading. There are a variety of trading derivatives for the USD, including the U.S. Dollar Exchange Exchange Exchange Meter (U.S. Dollar DXY). The numerator measures the strength of the dollar against other major currencies. For economists, this value reflects how much buying power you get when you trade the USD.

Two common types of currency strength calculations are fundamental-based and price-based. The fundamental calculation is a method of evaluating currency by its ability to "buy strong currency or sell weak currency." Using this method, if you are doing well with currency X-Y, you can determine if this is because X is strong or Y is weak. Price-based calculations evaluate currency based on its price movement.

The USDX is used as a reference for other indices and is a common measure of price-based currency strength. However, it does not always provide the most accurate indication of currency strength. That's why we have created a list of the 3 best currency strength meters that are better tools for traders looking to predict market value.

Macro Currency Strength Meter

The Macro Currency Strength Meter has the best quality standards and is our top pick.

This app is great if you're:

A) looking for a currency prediction

B) want to buy a variety of currencies

C) need a user-friendly app

D) need support if you have any issues. It's also great if you are

E) a swing trader, looking to buy and sell

F) trend trader, looking to trade for a long term trend

This novel currency strength meter was rated based on accuracy, price range, accessibility, user interface, customer support, and reliability. It correctly predicted numerous trends. For example, it is a good gage for trend traders, swing traders, and counter trend traders alike. The gage gets an excellent rating for its community.

Check out Live Currency Strength Meter to see how the major currencies are performing against others in real time. Strong currencies have green markers and weaker currencies have red markers. Rates are calculated based on daily charts from Friday's closing market. The arrows show the trend of each currency against the respective currency.